Assessment Pillars

How lending risk is measured in practice

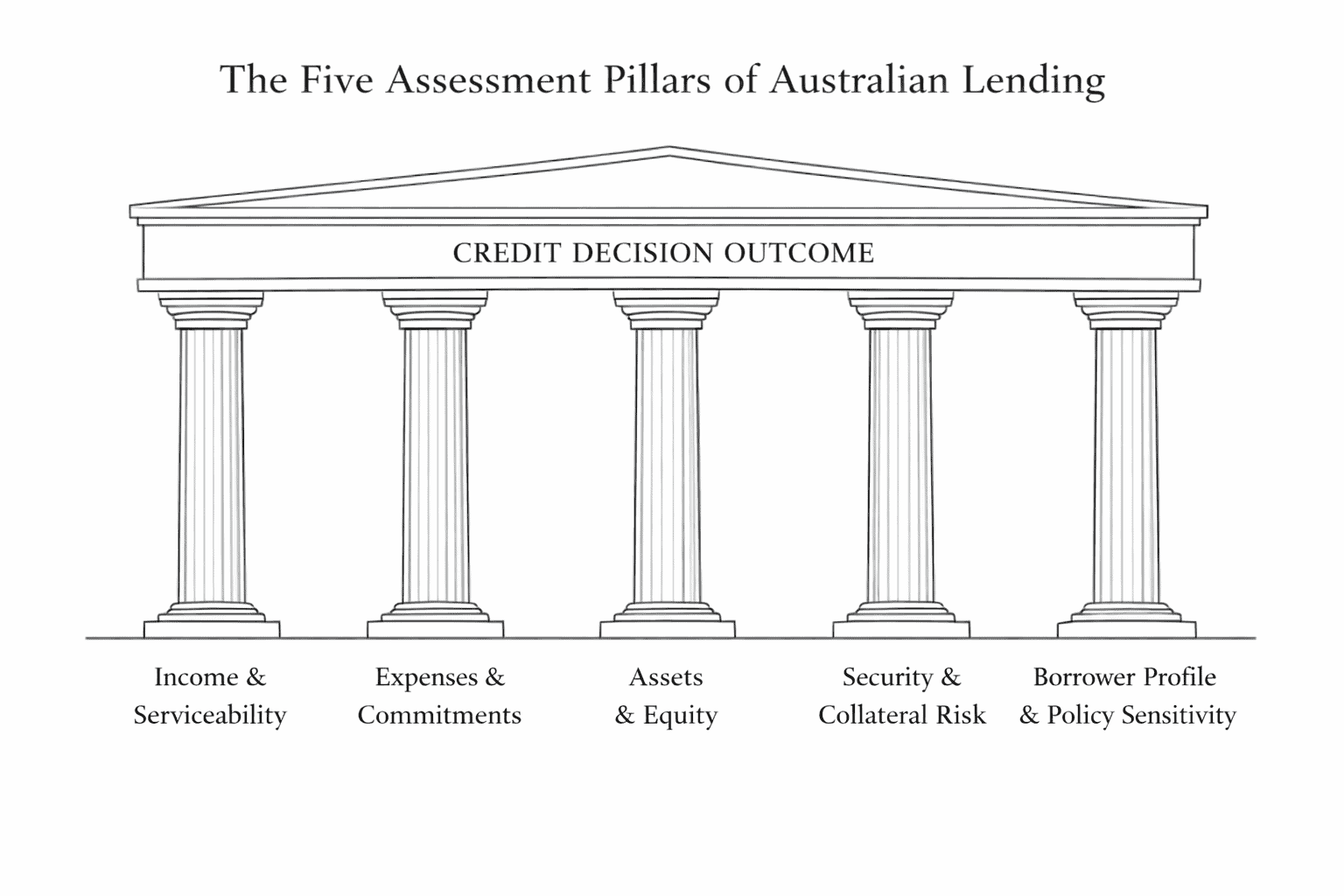

Australian lending decisions are evaluated through a structured measurement framework designed to interpret risk consistently

across residential, commercial, and asset finance. At the most fundamental level, every credit decision reflects

the Four Cs of Credit:

- Character

- Capacity

- Capital

- Collateral

In operational lending assessment, these foundational risk dimensions are examined through a set of interdependent

assessment pillars, each measuring a distinct category of financial or structural risk. No pillar operates in isolation, and strength in one area does not override weakness in another. The system is designed to contain risk, not to optimise outcomes for individual borrowers.

The Five Assessment Pillars

Income & Serviceability

Measures whether repayment obligations can be sustained over time under lender stress settings.

This includes:

- Income recognition and verification

- Stability, continuity and shading treatment

- Servicing buffers and stress rates

- Net surplus / repayment capacity under policy

→ View Income & Serviceability

Expenses & Commitments

Measures the minimum outgoings lenders must assume — whether declared or substituted by benchmarks.

This includes:

- Household benchmarks and override rules

- Existing debts, limits and repayment assumptions

- Ongoing commitments (HECS, child support, leases)

- Sensitivity to changes in expense assumptions

Assets & Equity

Measures the borrower’s capital position, leverage settings, and resilience to value change.

This includes:

- Deposit sources and acceptable evidence

- Usable equity and access pathways

- LVR settings and equity buffers

- Genuine savings / gift / sale proceeds treatment

Security & Collateral Risk

Measures the quality, marketability, and enforceability of the asset offered as security.

This explains how:

- Property type, location and zoning affect lending

- Valuation risk and market depth alter outcomes

- Certain securities restrict borrowing options

- → View Security & Collateral Risk

Borrower Profile & Policy Sensitivity

Measures how borrower attributes interact with lender policy, risk appetite, and exceptions.

This includes:

- Residency status, expat settings and overseas income policy

- Employment type, industry overlays and contract treatment

- Credit conduct signals and file interpretation

- Purpose, timeline and transaction complexity

→ View Borrower Profile & Policy Sensitivity

How the Pillars Work Together

Lending assessment evaluates all five pillars simultaneously.

For example:

- weak equity may tighten serviceability or security limits

- complex ownership may reduce lender availability

- execution or timing failure may negate otherwise

- acceptable credit metrics

The framework does not compensate for weakness.

It layers constraints to maintain acceptable risk.

Why Lending Outcomes Differ

Borrowers are often surprised when:

- higher income does not increase borrowing capacity

- similar assets produce different lending outcomes

- approval does not guarantee settlement

- equity exists but cannot be accessed

These outcomes are not anomalies.

They reflect the interaction of all assessment pillars together.

Scope of This Page

This page explains how lending risk is measured within

Australian credit assessment frameworks.

It does not:

- assess individual circumstances

- recommend borrowing strategies or lenders

- provide credit or financial advice

Understanding the framework is separate from applying

it to a real lending situation.

Part of the Model Mortgages Lending Framework

This page forms part of the Model Mortgages structured reference framework explaining how Australian lenders commonly assess income, expenses, assets, security risk and policy sensitivity under Australian credit policy settings.

The information provided is general educational information only and does not constitute credit advice, financial advice, legal advice or a recommendation.

It has been prepared without considering any individual’s objectives, financial situation or needs and must not be relied upon when making borrowing, investment or financial decisions.

Lending policies and outcomes vary between lenders and individual circumstances.

Model Mortgages Pty Ltd operates under Australian Credit Licence 387460.

Continue exploring the framework:

→ Explore the Five Assessment Pillars

→ Browse Canonical Lending Questions

© 2026 Model Mortgages Pty Ltd | Australian Credit Licence 387460 | ABN 82 108 681 063

General educational information only. Personal credit assistance is provided only through separate authorised engagement with Model Mortgages Pty Ltd.