How Lending Is Assessed

in Australia

Model Mortgages is a structured reference framework

explaining how Australian lenders assess income, expenses, assets, security risk and policy sensitivity when evaluating credit applications.

Why Lending Outcomes Differ

Many borrowers begin researching finance only after a lender has already completed its assessment. By that point, the outcome has already been shaped by factors that were never visible to them.

In Australia, lending outcomes are not determined by interest rates or product selection alone. They reflect structured credit assessment methods applied consistently across lenders — methods that most borrowers never see.

Each assessment considers how five factors interact:

- Income recognition and servicing capacity

- Existing commitments and living expenses

- Assets and available equity

- Property security characteristics

- Borrower profile and policy sensitivity

Understanding how these factors are assessed — and how they interact — explains why two borrowers in similar financial positions can experience very different lending outcomes. These assessment mechanics operate largely behind the scenes, which is why lending decisions often appear inconsistent to borrowers

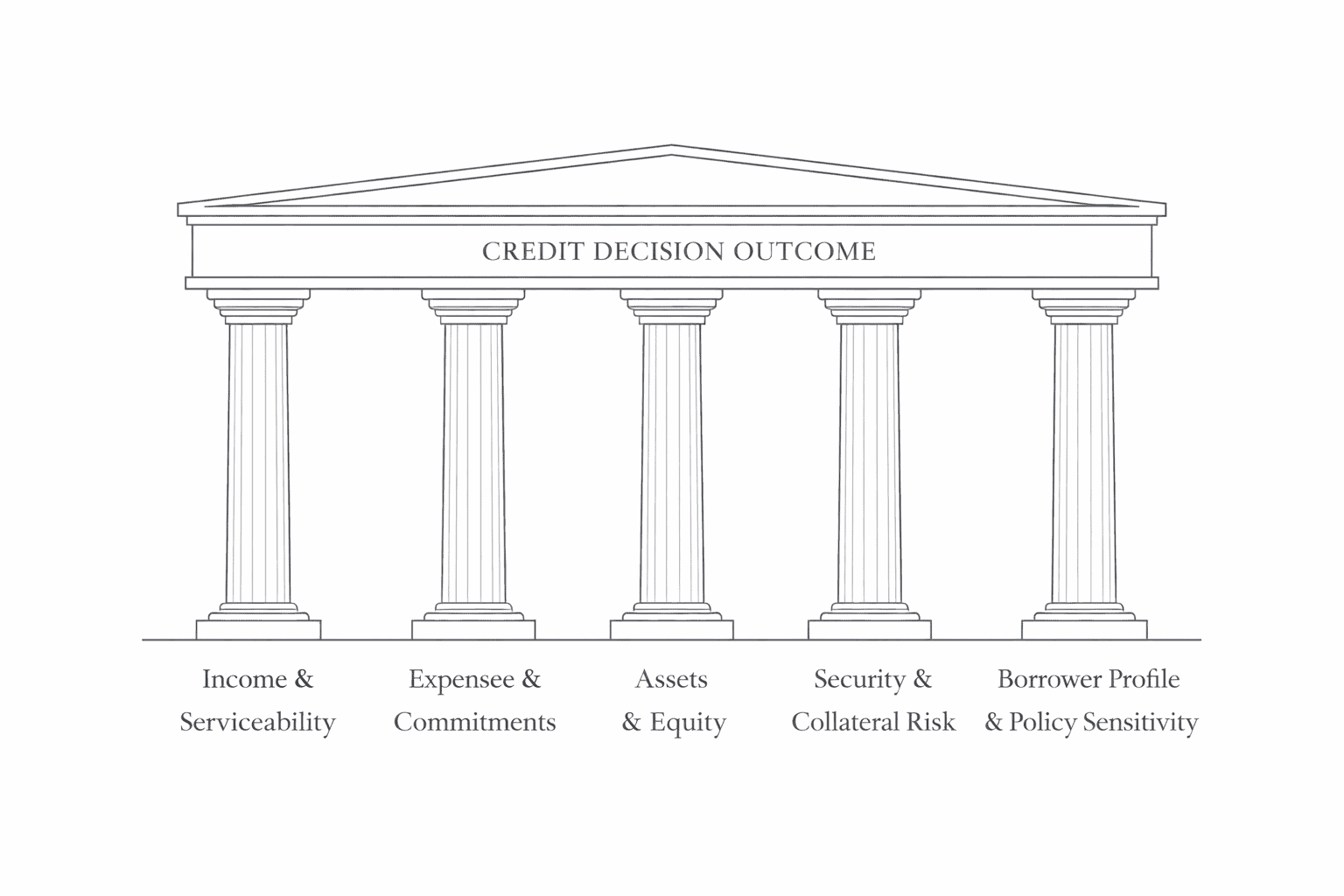

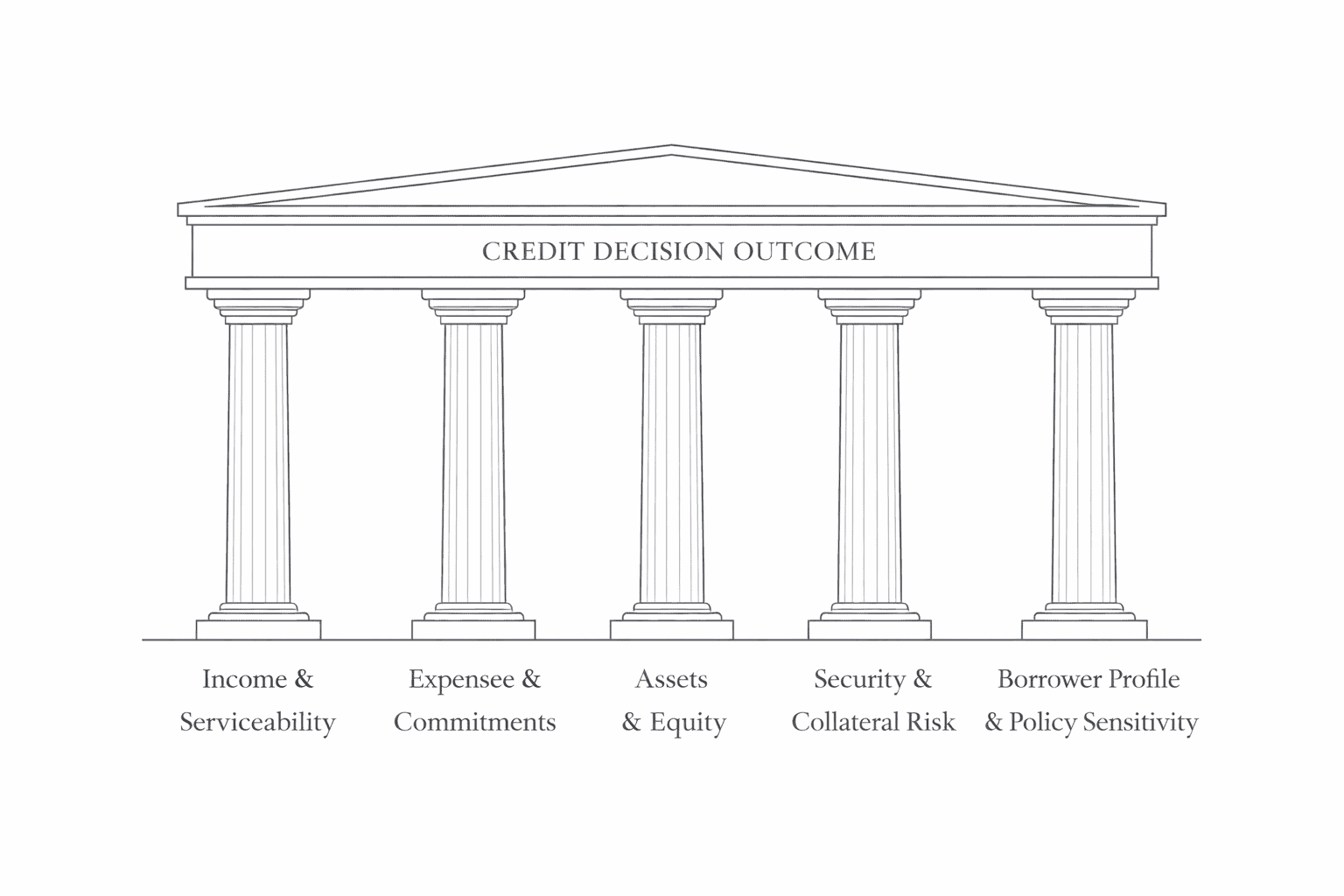

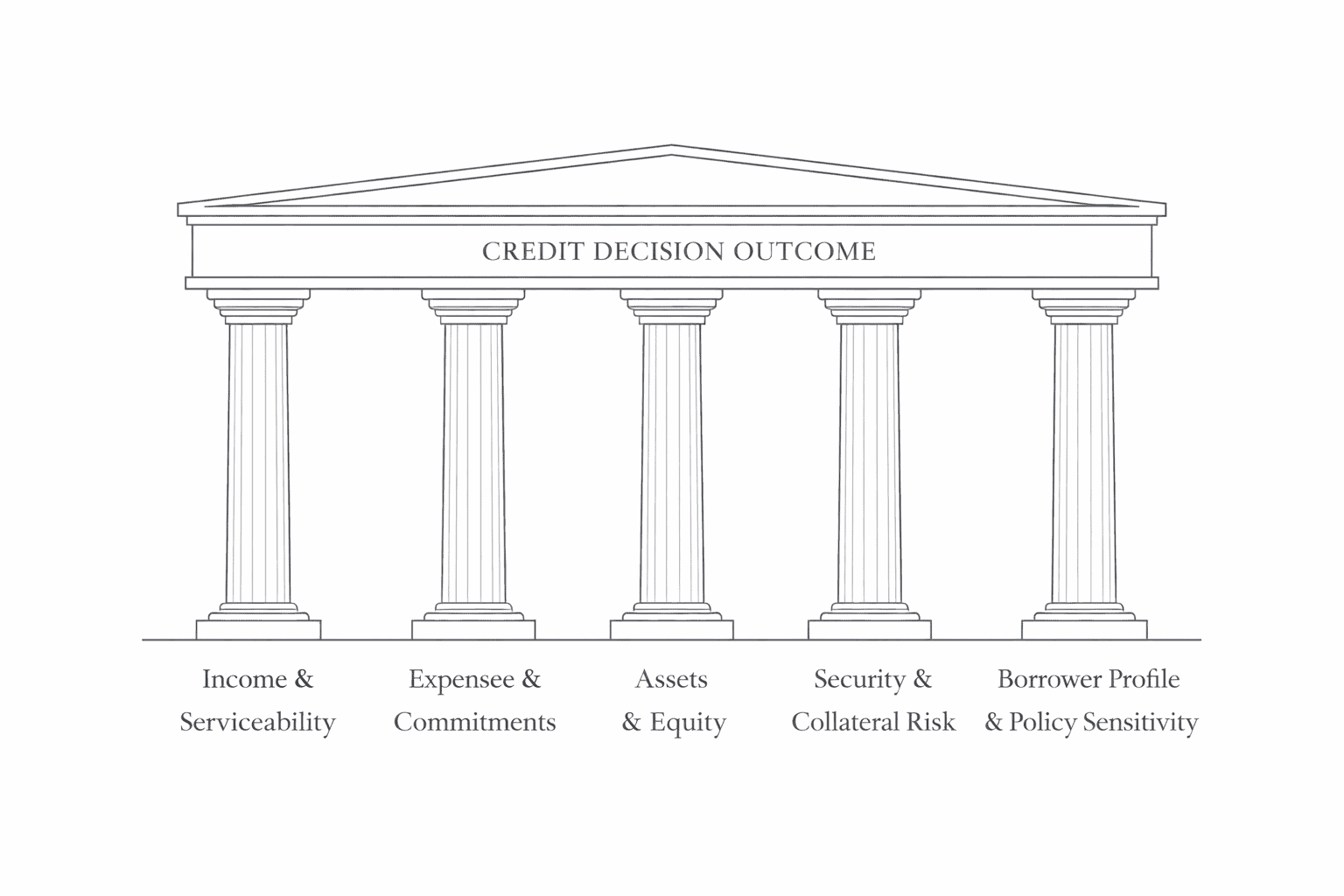

The Model Mortgages Lending Assessment Framework

Australian lenders assess credit applications using structured evaluation models designed to measure repayment sustainability and risk. Although individual lenders apply their own policies, the underlying assessment logic is remarkably consistent.

Model Mortgages documents that logic through five core assessment pillars, applied across residential, commercial and asset finance lending.

The 5 Assessment Pillars of Australian Lending

The Five Assessment Pillars

Income & Serviceability

How income is recognised, verified and tested for repayment sustainability.

Expenses & Commitments

How living costs and existing debts influence servicing calculations.

Assets & Equity

How deposits, ownership structures and equity positions affect lending strength.

Security & Collateral Risk

How property characteristics influence lender risk acceptance.

Borrower Profile & Policy Sensitivity

How employment type, residency status, profession and scenario complexity interact with lending policy.

Two Levels of Lending Assessment

The five pillars describe what lenders assess.

Canonical lending questions explain how those assessments are applied in practice

Understanding Lending Assessment Questions

Lending assessment is ultimately shaped by a series of recurring questions — applied consistently within lender credit policy frameworks, regardless of borrower type, profession or loan purpose.

Across thousands of lending scenarios, lenders evaluate many of the same underlying considerations. Within Model Mortgages, these recurring assessment considerations are referred to as canonical lending questions.

A canonical lending question represents a commonly applied credit assessment factor — used by lenders to evaluate repayment capacity, financial position, security risk and policy alignment.

These questions rarely operate in isolation. They interact, and they form recognisable patterns across different lending scenarios.

Model Mortgages organises them into ten structured canonical question clusters, reflecting how lenders interpret real-world financial circumstances.

The Ten Canonical Lending Question Clusters

- Income Recognition

- Living Cost Modelling

- Existing Debts

- Borrowing Capacity

- Deposit & Equity

- Credit Conduct

- Ownership Entities

- Security Risk

- Timing & Policy Changes

- Policy Sensitivity

Each cluster explains how lenders define risk, apply policy settings, calculate buffers and assess sustainable borrowing capacity.

Start With Structure

If you are reviewing your own borrowing position, the framework can be followed in a simple sequence:

- Begin at Start Here

- Identify which pillar is most relevant to your scenario

- Review the corresponding canonical question cluster

- Complete a structured snapshot of your position

Model Mortgages provides the assessment framework. Execution pathways operate separately.

A Structured Framework, Not a Comparison Site

Model Mortgages does not publish rates. It does not rank lenders. It does not offer instant approvals.

It explains structure.

When the structure of lending assessment is clearly understood, product selection becomes a far more informed decision.

Model Mortgages Pty Ltd

Australian Credit Licence 387460

Educational reference framework for Australian lending structure.

Authorship

Model Mortgages is authored by an Australian Credit Licence holder and reflects real-world credit assessment frameworks

applied across residential, commercial, and asset finance markets in Australia.

→ Author and professional background-

Part of the Model Mortgages Lending Framework

This page forms part of the Model Mortgages structured reference framework explaining how Australian lenders commonly assess income, expenses, assets, security risk and policy sensitivity under Australian credit policy settings.

The information provided is general educational information only. It does not constitute credit advice, financial advice, legal advice or a recommendation of any kind. It has been prepared without considering any individual's objectives, financial situation or needs, and must not be relied upon when making borrowing, investment or financial decisions. Lending policies and outcomes vary between lenders and individual circumstances.

Model Mortgages Pty Ltd operates under Australian Credit Licence 387460.

Continue exploring the framework:

→ Explore the Five Assessment Pillars

→ Browse Canonical Lending Questions

© 2026 Model Mortgages Pty Ltd | Australian Credit Licence 387460 | ABN 82 108 681 063

General educational information only. Personal credit assistance is provided only through separate authorised engagement with Model Mortgages Pty Ltd.